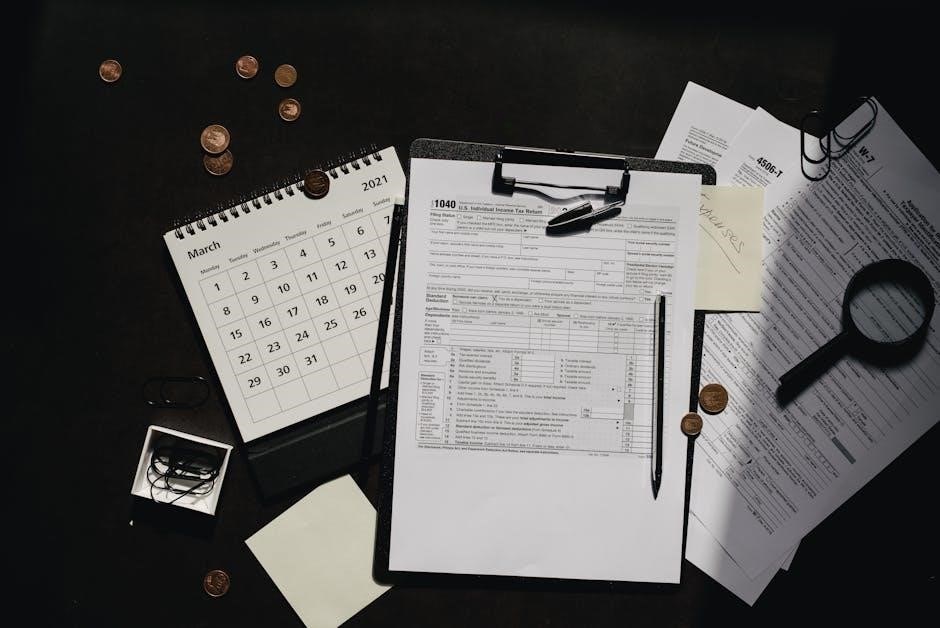

Form 990 Schedule G is a crucial IRS form for tax-exempt organizations to report fundraising and gaming activities, ensuring compliance and public transparency. Accuracy is essential.

1.1 Overview of Schedule G

Schedule G is an IRS form attached to Form 990, detailing fundraising and gaming activities. It requires nonprofits to report events, professional fundraisers, and financial data. Accuracy is crucial for compliance. Organizations must disclose revenue, expenses, and policies related to these activities. This schedule ensures transparency and accountability, helping the public and IRS assess the organization’s operations and adherence to tax-exempt purposes. Proper completion is vital to avoid penalties and maintain trust.

1.2 Purpose of Schedule G

The purpose of Schedule G is to provide detailed information about an organization’s fundraising and gaming activities. It ensures transparency by requiring disclosure of events, professional fundraisers, and financial details. This schedule helps the IRS and the public evaluate the organization’s compliance with tax-exempt requirements. By reporting revenue, expenses, and policies, nonprofits demonstrate accountability and adherence to their mission. Accurate completion of Schedule G is essential for maintaining tax-exempt status and public trust;

1.3 Importance of Accuracy in Schedule G

Accuracy in Schedule G is critical to maintaining compliance with IRS regulations and ensuring public trust. Inaccurate or incomplete reporting can lead to penalties, loss of tax-exempt status, and damage to an organization’s reputation. Precise details about fundraising events, professional fundraisers, and financial data must be provided. The IRS scrutinizes this information to assess compliance with tax-exempt requirements. Therefore, organizations must ensure all disclosures are truthful and align with their mission, fostering transparency and accountability.

Eligibility Criteria for Filing Schedule G

Organizations must file Schedule G if they engage in fundraising or gaming activities, with specific thresholds for reporting. It applies to nonprofits with significant fundraising expenses or gaming revenues.

2.1 Who Must File Schedule G

Nonprofits and tax-exempt organizations filing Form 990 or 990-EZ must file Schedule G if they engage in fundraising or gaming activities. This includes organizations with significant fundraising expenses or substantial gaming revenues. Filing is mandatory if the organization exceeds IRS thresholds for these activities, ensuring transparency and compliance with regulatory requirements.

2.2 Exemptions from Filing Schedule G

Certain organizations are exempt from filing Schedule G, such as churches, government entities, and those with limited fundraising or gaming activities. Specifically, nonprofits with fundraising expenses and gaming revenues below IRS thresholds may not need to file. Additionally, organizations that do not engage in professional fundraising or conduct gaming activities are exempt. These exemptions reduce administrative burdens for smaller or less active organizations while maintaining compliance for larger entities.

2.3 Thresholds for Reporting Fundraising Activities

Organizations must report fundraising activities if their gross receipts from events exceed $5,000. Additionally, if fundraising expenses surpass $1,000, detailed disclosures are required. Professional fundraisers must be disclosed if they manage contributions. Gaming activities are also subject to reporting if revenue exceeds $10,000. These thresholds ensure transparency and accountability, focusing on significant activities that impact an organization’s financial health and public trust. Accurate reporting within these limits is essential for compliance with IRS regulations.

Structure of Schedule G

Schedule G is divided into three parts: fundraising activities, gaming activities, and supplemental information. Each section requires detailed disclosures to ensure transparency and compliance with IRS regulations.

3.1 Part I: Fundraising Activities

Part I of Schedule G focuses on fundraising activities, requiring details about events, professional fundraisers, and financial data. Organizations must report their two largest events with gross receipts exceeding $5,000, including revenue and expenses. Additionally, they must disclose any professional fundraisers contracted, specifying their roles and compensation. This section ensures transparency into how nonprofits raise funds and manage related expenses, aligning with IRS guidelines for accountability.

3.2 Part II: Gaming Activities

Part II of Schedule G focuses on gaming activities, requiring organizations to report revenue and expenses from gaming operations. This includes bingo, raffles, and other games of chance. Organizations must disclose gross income, expenses, and net profits or losses. If gaming expenses exceed gross income, an explanation is required. This section ensures transparency into gaming-related financial activities, aligning with IRS requirements for tax-exempt organizations engaged in such operations.

3.3 Part III: Supplemental Information

Part III of Schedule G allows organizations to provide additional disclosures or explanations related to their fundraising or gaming activities. This section may include attachments or supporting documents to clarify reported information. It is used to address unique circumstances or provide further details on specific transactions. Supplemental information ensures transparency and compliance, giving the IRS a more comprehensive understanding of the organization’s financial activities. This section is optional but highly recommended for clarity.

Fundraising Activities (Part I)

Part I of Schedule G focuses on reporting fundraising events, professional fundraisers, and related financial details, ensuring transparency in nonprofit organizations’ fundraising practices and compliance with IRS requirements.

4.1 Reporting Fundraising Events

Organizations must report fundraising events with gross receipts exceeding IRS thresholds. Details include event name, date, location, expenses, and net income. This ensures transparency and accountability, aligning with IRS guidelines for accurate disclosure of fundraising activities. Proper documentation and categorization are essential to avoid compliance issues and ensure public trust in the organization’s financial practices.

4.2 Disclosing Professional Fundraisers

Organizations must disclose details about professional fundraisers, including their name, address, and activities performed. They must also report whether the fundraiser had custody or control of contributions. This disclosure ensures transparency in fundraising practices and helps the IRS assess compliance with regulations. Accurate reporting is critical to maintain public trust and avoid penalties for non-compliance with Schedule G requirements.

4.3 Financial Information Related to Fundraising

Organizations must report financial details about fundraising activities, including gross income, expenses, and net proceeds from events. Revenue from gaming activities must also be disclosed. The IRS requires precise reporting of these figures to ensure transparency and compliance. Accurate financial disclosure helps maintain public trust and demonstrates accountability in managing fundraising resources. Proper documentation and adherence to IRS guidelines are essential to avoid errors and penalties in Schedule G submissions.

Gaming Activities (Part II)

Schedule G Part II requires reporting on gaming activities, including types of games, revenue generated, and expenses incurred. Compliance with IRS regulations is mandatory.

5.1 Types of Gaming Activities

Schedule G Part II requires reporting on various gaming activities, such as bingo, raffles, and charitable gaming events. Organizations must disclose the types of gaming conducted and ensure compliance with IRS guidelines. Gross income and expenses related to gaming must be accurately reported. Additionally, the organization must indicate if gaming activities are a substantial part of its operations, adhering to specific reporting thresholds and requirements outlined by the IRS.

5.2 Reporting Gaming Revenue

Organizations must report gross gaming revenue on Schedule G, Part II. This includes income from bingo, raffles, and other gaming activities. Expenses directly related to gaming operations should also be disclosed. The IRS requires detailed breakdowns to ensure transparency and compliance. Accurate reporting of gaming revenue and expenses is critical to avoid penalties. Proper documentation and adherence to IRS guidelines are essential for maintaining compliance and public trust in the organization’s financial practices.

5.3 Expenses Related to Gaming

Organizations must report expenses related to gaming activities on Schedule G, Part II. These include costs directly tied to conducting gaming operations, such as prizes, supplies, and overhead. Expenses should be itemized and separated from revenue. Accurate reporting is crucial for compliance. The IRS requires detailed disclosure to ensure transparency and proper oversight. Failure to report gaming expenses correctly may result in penalties. Organizations must adhere to IRS guidelines to maintain compliance and public trust in their financial practices.

Supplemental Information (Part III)

Part III of Schedule G requires organizations to disclose additional details about their fundraising and gaming activities, ensuring transparency and compliance with IRS regulations. Accuracy is key.

6.1 Additional Disclosures

Under Part III, organizations must provide additional disclosures about their fundraising and gaming activities. This includes detailed descriptions of events, professional fundraisers involved, and revenue generated. Accuracy in reporting is crucial to ensure compliance with IRS guidelines. Organizations must also disclose any relationships with third-party vendors and explain how funds raised are utilized. Proper documentation and transparency are essential to avoid penalties and maintain public trust. This section ensures comprehensive reporting of all relevant activities.

6.2 Attachments and Supporting Documents

Organizations must attach relevant supporting documents to Schedule G, such as contracts with professional fundraisers, receipts, and financial statements. These attachments validate the information reported and ensure compliance with IRS requirements. Proper documentation helps prevent audits and penalties. Include details like event revenue, expenses, and vendor agreements. Ensure all records are organized and readily available for review. Accurate and complete documentation is critical for maintaining transparency and fulfilling regulatory obligations. This step ensures the integrity of the reported data.

6.3 Special Reporting Requirements

Special reporting requirements under Schedule G include disclosing non-cash contributions, sponsorship agreements, and specific fundraising methods. Organizations must report details on gaming activities, such as bingo or raffles, and any related expenses. Additionally, they must disclose relationships with professional fundraisers and provide narratives explaining unique fundraising practices. These requirements ensure transparency and accountability, meeting IRS standards for public disclosure. Compliance with these rules is essential to avoid penalties and maintain tax-exempt status. Always refer to the latest IRS guidelines for updates.

Compliance and Reporting Requirements

Compliance with IRS guidelines is crucial for accurate reporting on Schedule G. Organizations must ensure transparency in fundraising and gaming activities, adhering to all regulatory standards to avoid penalties and maintain tax-exempt status.

7.1 IRS Guidelines for Schedule G

The IRS provides detailed guidelines for completing Schedule G, emphasizing accurate reporting of fundraising and gaming activities. Organizations must disclose professional fundraisers, fundraising events, and related financial details. The IRS requires clear separation of fundraising expenses from program services. Additionally, gaming activities must be reported with specific revenue and expense breakdowns. Adhering to these guidelines ensures compliance and maintains transparency, avoiding potential penalties for incomplete or inaccurate reporting.

7.2 Penalties for Non-Compliance

Failure to comply with Schedule G reporting requirements can result in penalties, including fines and potential loss of tax-exempt status. Inaccurate or incomplete disclosures may trigger IRS audits and additional scrutiny. Organizations must ensure timely and accurate filing to avoid these consequences. Penalties also apply for failure to disclose professional fundraisers or gaming activities. The IRS emphasizes strict adherence to guidelines to maintain compliance and public trust. Non-compliance can lead to reputational damage and financial repercussions.

7.3 Record-Keeping Best Practices

Organizations should maintain detailed records of fundraising and gaming activities, including contracts, financial statements, and event details. Accurate documentation ensures compliance with IRS requirements and facilitates audits. Regularly reviewing and updating records is essential. Secure storage of electronic and physical files is recommended. Clear categorization of expenses and revenues helps in preparing Schedule G. Timely reconciliation of accounts prevents discrepancies. Implementing a systematic record-keeping process ensures transparency and accountability, reducing the risk of errors during filing.

Instructions for Completing Schedule G

Start with Part I, detailing fundraising events and professional fundraisers; Proceed to Part II for gaming activities and conclude with supplemental information in Part III. Ensure accuracy and compliance throughout the process.

8.1 Step-by-Step Filing Guide

Begin by reviewing eligibility criteria to determine if Schedule G is required. Next, gather detailed records of fundraising events, professional fundraisers, and gaming activities. Complete Part I by disclosing all relevant fundraising information, including revenue and expenses. For Part II, report gaming activities, such as bingo or raffles, and associated income. Finally, in Part III, provide any supplemental information and attach required documents. Ensure all data is accurate and aligns with IRS guidelines before submission.

8.2 Tips for Avoiding Common Errors

Thoroughly review IRS guidelines to ensure compliance. Accurately report all fundraising and gaming details, avoiding omissions. Correctly classify activities to prevent misreporting. Double-check financial calculations to eliminate errors. Ensure all required attachments are included. Verify professional fundraiser disclosures for completeness. Avoid late submissions to prevent penalties. Regularly update records to reflect current data. Seek professional advice for complex scenarios to ensure accuracy and adherence to IRS standards.

8.3 Submitting Schedule G to the IRS

Submitting Schedule G to the IRS is straightforward when properly prepared. Ensure all required sections are complete and accurate. Electronic filing is recommended for efficiency and accuracy. Use IRS-approved software to submit Form 990, including Schedule G. Verify that all attachments and supporting documents are included. Adhere to IRS deadlines to avoid penalties. Ensure the filing includes clear disclosure of fundraising and gaming activities. Confirm receipt of submission via email or platform notification for record-keeping purposes.

Common Mistakes to Avoid

Common mistakes include incomplete reporting of fundraising events, misclassifying activities, and failing to disclose required information. Ensure accuracy and transparency to comply with IRS guidelines and avoid penalties.

9.1 Incomplete or Inaccurate Reporting

Incomplete or inaccurate reporting is a common mistake that can lead to penalties. Ensure all fundraising and gaming activities are fully disclosed, including financial details and professional relationships. Misclassifying events or failing to report revenue thresholds can trigger IRS scrutiny. Double-check all data for accuracy and completeness before submission. Inconsistent or missing information can delay processing or result in compliance issues. Always verify totals and ensure alignment with core Form 990 data.

9.2 Misclassifying Fundraising or Gaming Activities

Misclassifying fundraising or gaming activities is a frequent error. Ensure events are correctly categorized as either fundraising or gaming, as each has specific reporting requirements. Mislabeling can lead to incorrect financial disclosures and IRS penalties. Clearly distinguish between donations, event proceeds, and gaming revenue. Verify that all activities align with IRS definitions to avoid misclassification. Proper categorization ensures accurate reporting and maintains compliance with Schedule G requirements. Always cross-reference IRS guidelines to confirm activity types.

9.3 Failing to Disclose Required Information

Failing to disclose required information on Schedule G can result in penalties and compliance issues. Ensure all fundraising and gaming details are fully reported, including professional fundraiser contracts, event expenses, and revenue. Omitting critical data, such as fundraiser names or activity descriptions, can trigger IRS scrutiny. Double-check Part I and Part II for completeness. Accurate disclosure ensures transparency and avoids potential audits or fines. Always verify that all required fields are filled out thoroughly and correctly.

Best Practices for Schedule G Preparation

Engage professionals for accuracy, review IRS guidelines, and ensure transparency in reporting fundraising and gaming activities to avoid errors and comply with regulations effectively.

10.1 Engaging Professional Assistance

Engaging professionals, such as tax experts or nonprofit consultants, ensures accurate preparation of Schedule G. They provide expertise in interpreting IRS guidelines, navigating complex reporting requirements, and avoiding errors. Professionals can help organizations understand nuances in disclosing fundraising and gaming activities, ensuring compliance with transparency standards. Their assistance is particularly valuable for interpreting Part I and Part II, as well as managing supplemental information in Part III. This expertise minimizes risks of penalties and ensures a smooth filing process.

10.2 Reviewing IRS Resources and Guidelines

Reviewing IRS resources and guidelines is essential for accurate Schedule G preparation. The IRS provides detailed instructions, forms, and updates on its official website. Organizations should consult the Form 990 Instructions and Schedule G guidelines to ensure compliance. These resources clarify reporting requirements, definitions, and best practices. Regularly checking IRS updates helps organizations stay informed about changes in tax laws or reporting standards, ensuring their filings are accurate and complete. This step minimizes errors and penalties, promoting transparency and accountability.

10.3 Maintaining Transparency in Reporting

Maintaining transparency in Schedule G reporting is vital for public trust; Organizations must clearly disclose fundraising and gaming activities, ensuring accuracy and completeness. Detailed financial data and narratives provide stakeholders with a clear understanding of operations. Transparency also involves avoiding vague descriptions and ensuring all required disclosures are made. By adhering to IRS guidelines and presenting information openly, organizations demonstrate accountability and integrity, fostering confidence among donors, regulators, and the public. This practice aligns with the IRS’s emphasis on clear and truthful reporting.

Form 990 Schedule G is essential for transparent reporting of fundraising and gaming activities, ensuring compliance and accountability. Accurate filing helps maintain public trust and avoid penalties.

11.1 Summary of Key Points

Form 990 Schedule G is essential for tax-exempt organizations to report fundraising and gaming activities transparently. It ensures compliance with IRS guidelines, avoiding penalties. Accuracy in reporting events, professional fundraisers, and financial details is crucial. The form is structured into three parts, covering fundraising, gaming, and supplemental information. Organizations must adhere to thresholds and disclose required details to maintain public trust and accountability. Proper preparation and adherence to IRS instructions are vital for successful filing.

11.2 Final Tips for Successful Filing

Ensure accuracy by reviewing IRS guidelines and consulting professionals. Double-check all financial data and disclosures. Maintain clear records and transparency in reporting. Verify compliance with thresholds for fundraising and gaming activities. Submit all required attachments and supplemental information. Avoid common errors by following step-by-step instructions. Ensure timely submission to meet deadlines and prevent penalties. Utilize IRS resources and tools for guidance. Organize documentation meticulously to simplify the filing process and ensure compliance with all requirements.

Additional Resources

Visit the IRS website for official forms, instructions, and guidelines. Utilize online tools and tutorials for step-by-step guidance. Consult professional advisors for personalized support and compliance expertise.

12.1 IRS Publications and Forms

The IRS provides official publications and forms on their website, including Form 990 and Schedule G. These resources offer detailed instructions for completing the form accurately. Visit irs.gov to access the core form, supplementary schedules, and guidelines. The IRS also publishes updates and revisions to ensure compliance with current tax regulations. Utilizing these official resources helps organizations maintain transparency and adhere to reporting requirements effectively.

12.2 Online Tools and Tutorials

The IRS offers online tools and tutorials to assist with completing Form 990 Schedule G. These resources include step-by-step guides, webinars, and interactive tutorials. Third-party software, such as TaxExemptHub, also provides tools to streamline the filing process. Additionally, the IRS website features video tutorials that explain complex sections of Schedule G, ensuring clarity and accuracy. These resources are designed to help organizations navigate the requirements efficiently and maintain compliance with IRS guidelines;

12.3 Professional Advisors and Support

Engaging professional advisors is crucial for accurate Form 990 Schedule G preparation. Certified public accountants (CPAs) and tax attorneys specializing in nonprofit law can provide expert guidance. The IRS website offers resources, but consulting professionals ensures compliance with complex regulations. Additionally, organizations can seek support from nonprofit associations or tax-exempt organizations that offer training and workshops. Professional advisors help navigate intricate reporting requirements, ensuring transparency and avoiding penalties. Their expertise is invaluable for maintaining compliance and meeting filing deadlines effectively.